PDF(2237 KB)

PDF(2237 KB)

PDF(2237 KB)

PDF(2237 KB)

PDF(2237 KB)

PDF(2237 KB)

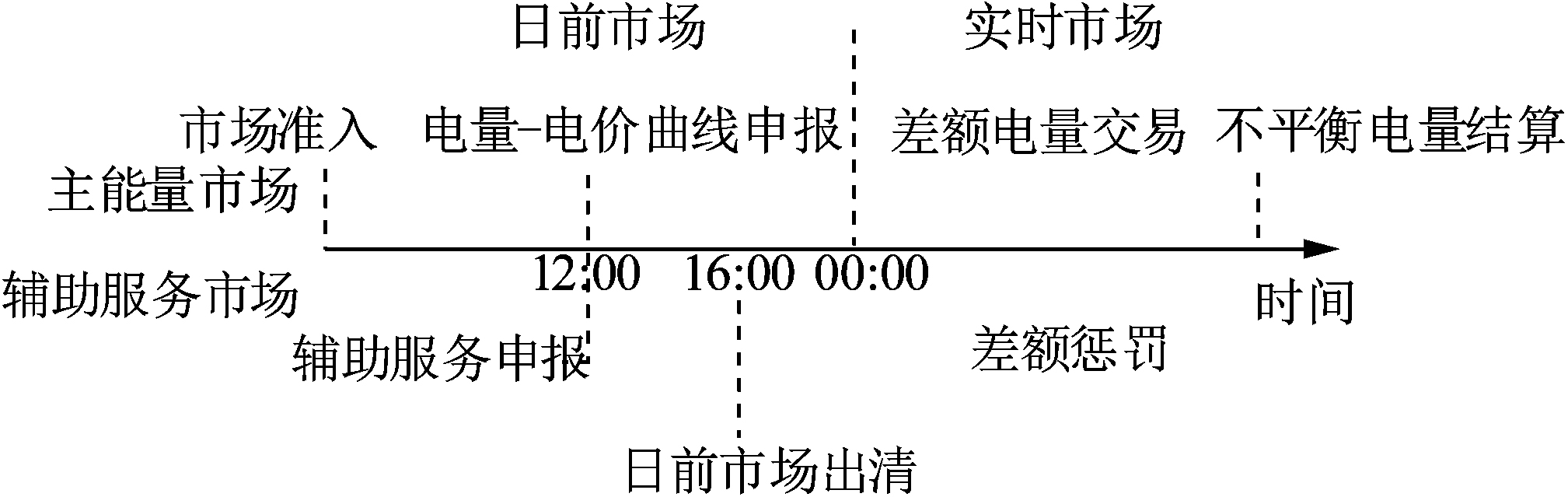

电力市场下的虚拟电厂风险厌恶模型与利益分配方法

({{custom_author.role_cn}}), {{javascript:window.custom_author_cn_index++;}}

({{custom_author.role_cn}}), {{javascript:window.custom_author_cn_index++;}}Risk Aversion Model and Profit Distribution Method of Virtual Power Plant in Power Market

({{custom_author.role_en}}), {{javascript:window.custom_author_en_index++;}}

({{custom_author.role_en}}), {{javascript:window.custom_author_en_index++;}}

| {{custom_ref.label}} |

{{custom_citation.content}}

{{custom_citation.annotation}}

|

/

| 〈 |

|

〉 |